Simon Property Group (NYSE: SPG) has collapsed due to COVID-19. The company has seen its share price drop from a 52-week peak of $163.6 and a mid-2016 peak of $227. That’s a near $50 billion market capitalization drop from its mid-2016 peak and a $30 billion market capitalization drop from its 52-week high. However, despite this collapse, the company’s new post-dividend cut yield of near 8% is incredibly exciting.

More so, as we’ll see throughout this article, a recent article purporting that a group dilution is necessary isn’t required.

Simon Property Group – Simon Property Group

Simon Property Group Dilution Requirement

Let’s start by discussing Simon Property Group’s dilution requirement from a fellow contributor’s article.

Source: Macrotrends chart

Source: Macrotrends chart

The argument of the article is simple. Simon Property Group’s “shareholder’s equity” has been declining for several years, ergo an equity raise on the order of several billion dollars would be required. However, the flaw in the article is it doesn’t explain why the company requires a certain debt-to-equity ratio or why the equity is required to be a certain level.

However, this can be highlighted in more detail in an astute comment described by “Life on Dividends“.

“There are several ways to value real estate, but the easiest is to take Net Operating Income (NOI) and divide it by a cap rate. Using the NOI figure for the first six months of the year (see SPG’s Q2 presentation page 16) of 2.384b and annualizing it the result for the year is 4.768b. Divide this figure by a cap rate of 7% and SPG’s real estate is worth 68.11b versus the 14.38b it is carried at on the balance sheet. Using the 53.73b (68.11b – 14.38b = 53.73b) figure as the value for the company’s real estate instead of 14.38b results in balance sheet equity of 39.35b versus the 2.3b GAAP equity shown. Debt/equity is now 0.86 (34b in debt / 39.35b in equity = 0.86) versus 14.7. Now you see why SPG has an “A” rating. By the way, if a cap rate of 6% is used instead of 7%, the resulting debt/equity is 0.50.

I am not the only one who values SPG’s assets this way. The company’s lenders do as well. On page 13 of the Q2 supplement, the debt covenants are detailed. The footnote at the bottom of the page states that total debt / total assets is to be calculated by taking NOI and dividing it with a 7% cap rate and adding back “other assets”. The covenant requires total debt / total assets < 65% and the company calculates that they ended Q2 at 44%. Bottom line is SPG is not debt heavy at all.”

Essentially, what the argument boils down to, is that “shareholder’s equity” is an entirely incorrect way to value a real estate company. A quick look at Simon Property Group’s balance sheet would explain why this is the case. Shareholder’s equity comes from “total assets” minus “total liabilities”. This remaining equity is dividend by number of shares to get equity per share.

The first items in Simon Property Group’s balance sheet are “Investment properties, at cost” at $37.972 billion minus “accumulated depreciation” at $14.489 billion. That gets $23.582 billion. However, as the comment above clearly explains, valuing that real estate at $23.582 billion makes no sense and it isn’t how the company’s lenders value it.

Instead, the company’s lenders use a logical cap rate on the company’s net operating income for assets. For the first 6 months of 2020, counting investments, that number was $2.88 billion versus $3.42 billion for the first 6 months of 2019. That comes out to $5.76 billion annualized versus $6.84 billion annualized.

*We chose to use the company’s combined NOI counting new developments versus comparable.

Utilizing a 7% capitalization rate, that comes out to $82 billion in 2020, down from property value of $98 billion in 2019. The company needs to keep total debt/total assets at <65% and are at 44%. With total liabilities at $31 billion, the company has room to increase its debt significantly. In fact, it can increase its debt by near enough to acquire the company at its current market capitalization.

That’s in a peak-COVID-19 world versus pre-COVID-19 and highlights how undervalued the company is. More so, it highlights how manageable the company’s debt is versus needing to issue new equity. More so, it’s worth highlighting here that the minimal decline in the company’s net income so far highlights the strength of its assets.

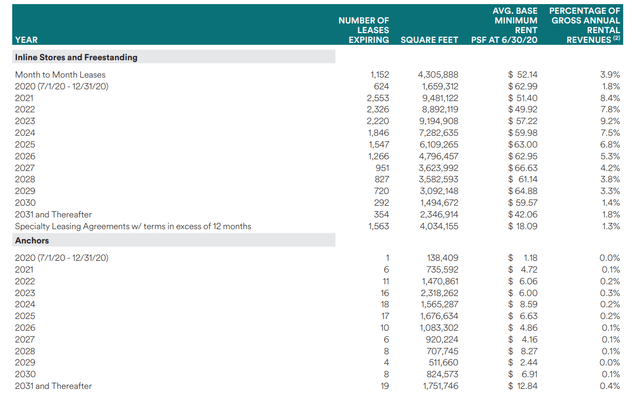

Simon Property Group Lease Expiration

At the same time, Simon Property Group has minimal lease expirations that will help maintain financial strength post COVID-19.

Simon Property Group Lease Expiration – Simon Property Group Investor Presentation

Simon Property Group has 3.9% as month-to-month leases with 1.8% expiring in the remainder of 2020 and 8.4% expiring in 2021. That represents a total of potential applications of 14.1% from now until YE 2021. That’s a respectable amount, but it’s very manageable for the company’s cash flow and potential shareholder rewards.

More so, a 14% drop in net income for the company would mean no threat for the company’s debt covenants.

Simon Property Group Opportunity

Going forward, the company has significant opportunity for shareholder rewards. The company’s net income attributable to common shareholders has collapsed from $1.043 billion for the first 6 months of 2019 to $700 million for the first 6 months of 2020. This comes with $665 million in 6-month depreciation expenses, which is cash flow the company can use.

Simon Property Group FFO – Simon Property Group Investor Presentation

Simon Property Group’s FFO of the operating partnership for 2020 will come in at $1.5 billion annualized, down from $2.2 billion in 2019. The company’s newly cut dividend costs it $1.6 billion on an annualized basis. The company’s share of capital expenditures is $300 million annualized, meaning the company is $400 million short for 2020 but $300 million extra in a normal year.

That amount of money is more than affordable for the company, and means that in a normal year, the company could increase its dividends to more than 9%. We believe that’s a yield that investors can comfortably expect and shows why investing in the real estate company is a strong opportunity.

Simon Property Group Risk

Simon Property Group’s risk is quite clear. The company has seen its net income drop significantly as a result of COVID-19. Should COVID-19 last much longer, the company’s lower net income could result in an even further dividend cut to a more sustainable yield in the 6-7% range. However, that’s still a quality dividend.

Conclusion

Simon Property Group has had a difficult year. The company has seen its net income drop significantly as a result of COVID-19. However, despite this collapse, the company has significant potential for strong shareholder rewards with a current yield of more than 7% and the ability to expand that to 9% in a normal year.

Investing in real estate means reliable cash flow for shareholders. Even if the company needs to cut dividends further, it’ll have a 6% reliable yield, with the ability to recover to 9% in a normal environment. That dividend will define strong shareholder rewards and make investing in the company a quality long-term opportunity.

The Energy Forum can help you generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing and you can be a part of this exciting trend.

Also read about our newly launched “Income Portfolio”, a non sector specific income portfolio.

The Energy Forum provides:

- Managed model portfolios to generate high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic market overviews.

Disclosure: I am/we are long SPG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.