Intro

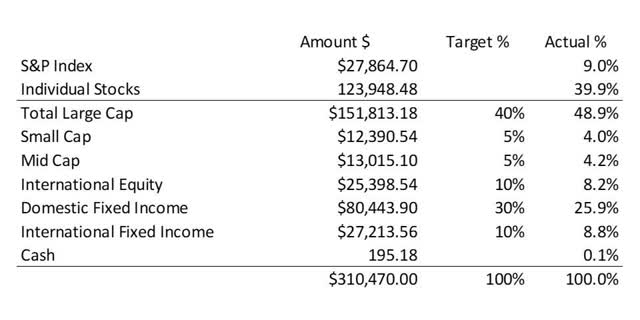

As the equity markets continue to recover I am becoming more and more underweight in my fixed income investments. I am targeting 40% in total fixed income investments and as of July 31 I am sitting at 34.7%. If I were to do a hard re-balance I would need to shift about $16,500 from large cap equities to fixed income.

I don’t want to do that, certainly not all at once, but I do plan on being slightly more aggressive in adding to my fixed income funds starting in August.

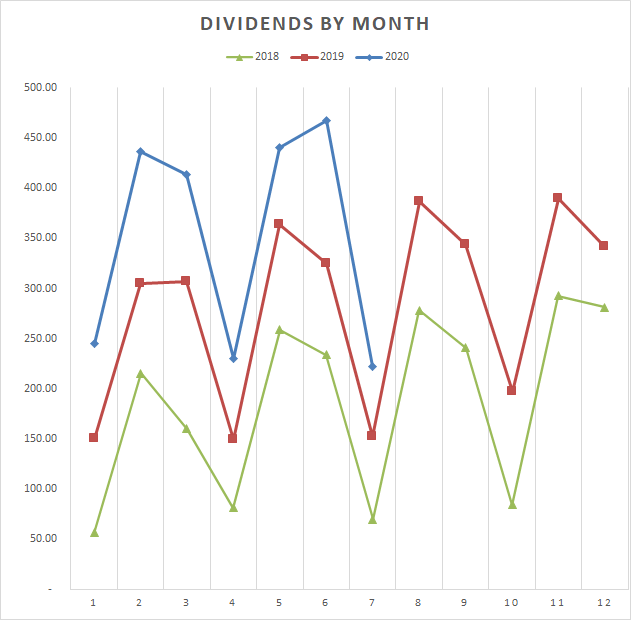

However, that is not in any way exciting and if you are like me you would rather discuss the dividends that our portfolios are cranking out. To me it is a lot more fun to get paid for owning a piece of the company than by lending them money. With that in mind let’s look at the dividends collected in July.

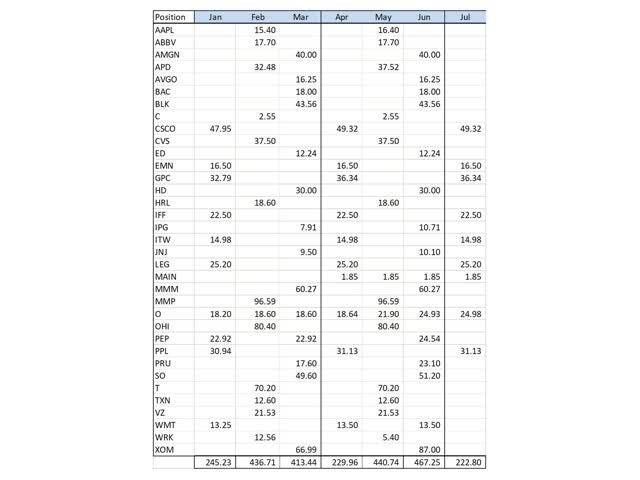

July Dividends

All graphs and charts created by author unless otherwise specified

All graphs and charts created by author unless otherwise specified

The first month of the quarter is always a little light for me, but July’s total of $222.80 does exceed last July’s total of $152.65. Nice to think that I no longer have sub-$200 months where just a year ago I was in the $150 range for January, April, and July.

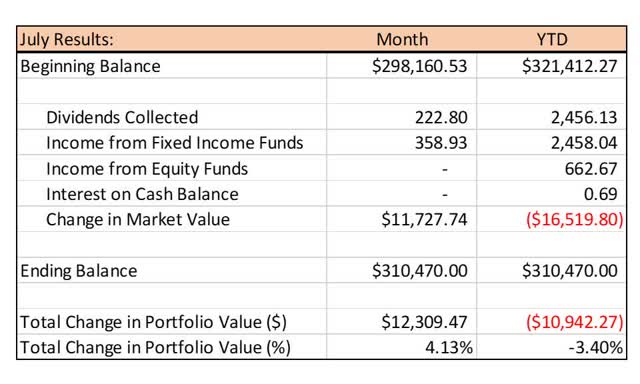

July Performance

The S&P 500 notched a 5.5% gain in July while the Dow Jones Industrial Average gained 2.4% this month. My portfolio came in right between there with a 4.13% gain. I’m back over $300k and within striking distance of pulling even for the year, which is remarkable and almost unthinkable back in March and April. One more month like this one and I should be in the green.

The S&P 500 notched a 5.5% gain in July while the Dow Jones Industrial Average gained 2.4% this month. My portfolio came in right between there with a 4.13% gain. I’m back over $300k and within striking distance of pulling even for the year, which is remarkable and almost unthinkable back in March and April. One more month like this one and I should be in the green.

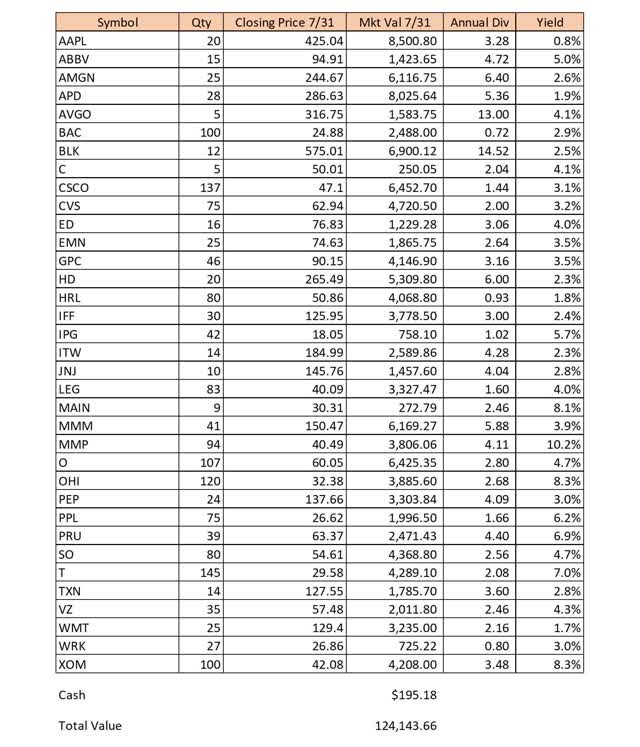

Individual Stocks

Here are my positions as of the close of business on July 31: My two energy stocks were each down a further 6% leading to some bloated yields. These are the two stocks whose dividends I’m worried about most.

My two energy stocks were each down a further 6% leading to some bloated yields. These are the two stocks whose dividends I’m worried about most.

One of the biggest pieces of news in July came at the end of the month as Apple Inc (NASDAQ:AAPL) announced a four for one stock split, effective later in August. Speaking of AAPL, that stock was up 16.5% in the month of July, but that was not my best performing stock this month. Air Products and Chemicals, Inc. (APD) which I called out last month as being up 22% YTD announced an earnings beat in July. The stock was up another astounding 18.7% in the month of July. That rather boring stock is treating me very well.

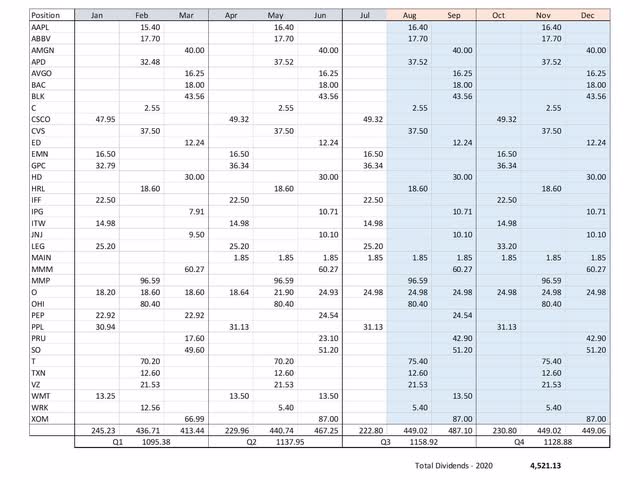

Projected Dividends

Total projected dividends for the year 2020 are now $4,521.13, assuming no changes in dividend policy for any of my stocks. I am expecting at least a few more raises as we head into fall, but as we are heading into fall that also means a dividend hike will not have much of an effect on 2020 dividend income.

Total projected dividends for the year 2020 are now $4,521.13, assuming no changes in dividend policy for any of my stocks. I am expecting at least a few more raises as we head into fall, but as we are heading into fall that also means a dividend hike will not have much of an effect on 2020 dividend income.

Sector Diversification

| Current Weight | Target Weight | |

| Consumer Discretionary | 10.3% | 10.0% |

| Consumer Staples | 8.6% | 8.0% |

| Energy | 6.5% | 7.5% |

| Financials | 10.0% | 10.0% |

| Health Care | 11.1% | 12.0% |

| Industrials | 7.1% | 8.5% |

| Materials | 11.6% | 5.0% |

| REIT | 8.3% | 7.5% |

| Technology | 14.8% | 15.0% |

| Communication Services | 5.7% | 9.0% |

| Utilities | 6.1% | 7.5% |

| 100% | 100% |

Energy stocks, as I mentioned, were beaten up again in July and although it is a somewhat scary proposition I might add to one of my positions or open a new one if I can find one that I love.

Communications Services is still my most underweight sector, but it is hard to find new dividend growth stocks in that sector because there just aren’t very many to choose from. I may have to bring back the format of articles I wrote when I first started assembling this portfolio. More to come on that.

Asset Allocation of the Portfolio

As I said at the top of the article, the percentage of my fixed income investments continues to shrink, despite being up 3.0% last month. My large cap stocks were up 4.8% for the month, which is a good problem to have but the idea of selecting an asset allocation model and trying to stick to it through re-balancing is you are buying asset classes when they are out of favor relative to your other asset classes. I don’t want to get too deep into Modern Portfolio Theory, but that is the general idea.

So I will endeavor to add more than just a few hundred dollars to my fixed income investments and I will likely need to tone down my stock purchases to do that. That will limit the dividend growth of my portfolio in the short term but hopefully in the long term it will provide buckets of cash for me to make stock purchases in the future.

Purchases in July

The only purchase I made in July was using my available cash to scoop up eight more shares of Prudential Financial, Inc. (PRU) at $59.38 per share, a 7.4% yield at that price. I sold nothing in this portfolio in July.

Forward Looking Dividends

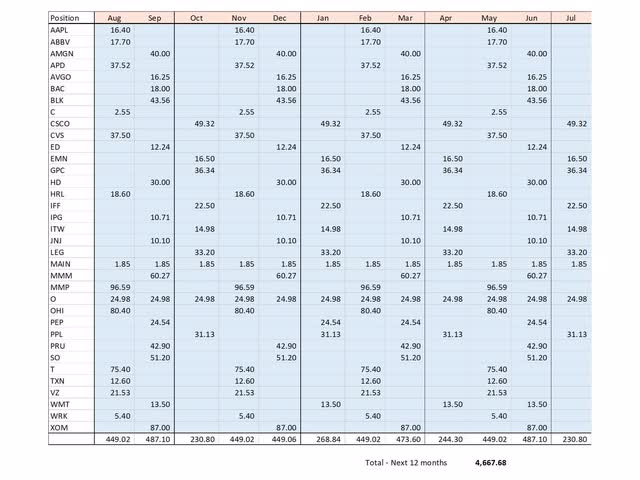

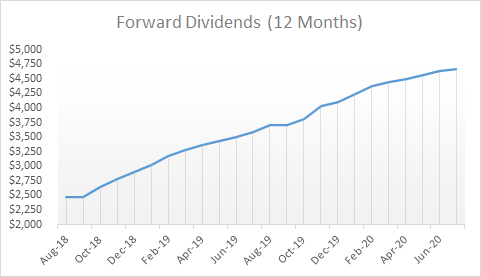

Total dividends projected over the next twelve months now sits at $4,667.68. I made a slight error in my last update article and neglected to include my purchase of PRU on June 26th in my previous calculations. As a result, more than half of the increase shown over last month’s total was from a June purchase. I have updated the graph and my tables so the actual increase in dividend payments since last month is $35.20. There were no dividend increases (or cuts) announced in July, so the $35.20 from the eight new PRU shares was the only increase.

Total dividends projected over the next twelve months now sits at $4,667.68. I made a slight error in my last update article and neglected to include my purchase of PRU on June 26th in my previous calculations. As a result, more than half of the increase shown over last month’s total was from a June purchase. I have updated the graph and my tables so the actual increase in dividend payments since last month is $35.20. There were no dividend increases (or cuts) announced in July, so the $35.20 from the eight new PRU shares was the only increase.

Final Thoughts

July was an excellent month as the economy continues to re-open in most places and the market is likely anticipating some sort of return to normal in the near to intermediate term. In the short term I have a few goals in mind and I will do my best to keep you all posted.

First, I plan on adding heavily to my fixed income investments for the remainder of the year. As I said, this means I’ll be taking a bit of a pause or at least I’ll be slowing down my purchase of more equities. Once the total percentage of fixed income gets back to the 37-38% range instead of 34.7% perhaps I will ease up on my fixed income purchasing. Until then, however, I feel that I must start correcting this now. It’s gotten lopsided enough for me.

Second, there are now four stocks that have or will fall off of the dividend champions list because the payouts have either been cut or are stagnant. I’ve already mentioned the two bank stocks, and they could raise the dividend before next fall and theoretically that would be a dividend increase for the year. The other one I’ve mentioned before is CVS Health (CVS) and they are doing a very good job of reducing their debt lately. And the fourth is WestRock Company (WRK) which I wrote about here and which I am still torn on which way I should go. Luckily they are a very small portion of my portfolio. My goal in the near future is to have articles on the bank stocks and on CVS and possibly make a decision on all four of these stocks as to whether I should sell them or hold.

And finally I need to either find a new stock in the communications sector or I need to convince myself to deploy more capital to one of the three I already have. Fidelity recommends an almost 11% weighting in communications stocks and I have set the goal for my portfolio at 9%, but right now only have 5.7% invested there. I would like to raise that a fair amount by the end of the year.

That should keep me busy for a while. I hope you all enjoyed the update and hope you are all staying healthy and safe. Good luck with your investment goals and as always thanks for reading!

Disclosure: I am/we are long AAPL, ABBV, AMGN, APD, AVGO, BAC, BLK, C, CSCO, CVS, ED, EMN, GPC, HD, HRL, IFF, IPG, ITW, JNJ, LEG, MMM, MMP, O, OHI, PEP, PPL, PRU, SO, PRU, T, TXN, VZ, WMT, WRK, XOM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.